It’s tax time! Here’s a little help with the federal solar tax credit: our step-by-step guide for how to do the paperwork needed to get your credit. We know you may have questions about what the tax credit covers, how to file your paperwork, and what documentation you may need. So read on for all the info you need about the 30% federal tax credit…

If you need some background on what the federal solar tax credit (aka Investment Tax Credit or ITC) is, check out our recent post all about the ITC to learn more. Otherwise, below you’ll find the nuts and bolts details on how to take advantage of your 30% credit!

First, what exactly is a tax credit?

It’s important to remember that a tax credit is different from a tax deduction. The tax credit means that you will be able to deduct the full 30% of the total cost of your solar project from your total tax liability, rather than as a deduction from your taxable income.

It’s basically a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000.

Who is eligible for the 30% tax credit?

If you install solar on your home at any time through the end of 2032, you are entitled to the 30% tax credit. There’s no dollar limit on those expenses; you’re entitled to that 30 percent tax break whether you spend $20,000 or more than $100,000 on costs associated with a residential solar system.

What does the 30% tax credit cover?

According to the Department of Energy, the ITC covers these expenses:

- Solar photovoltaic (PV) panels.

- PV cells used to power an attic fan (but not the fan itself).

- Contractor labor for onsite preparation, assembly, or original installation.

- Permitting fees, inspection costs, and developer fees.

- All equipment needed to get the solar system running, including wiring, inverters, and mounting equipment.

- Storage batteries **one important change is that you can now claim the 30% tax credit for standalone storage…it does not have to be paired with solar.**

- Sales taxes on eligible expenses.

How do I claim my 30% credit?

For residential customers, taking advantage of the solar ITC is simple. All you need to know is the total amount you paid for your solar project. You may have that information in your files, or you can call us at (202) 280-2285 and ask for your paperwork — we’re happy to help!

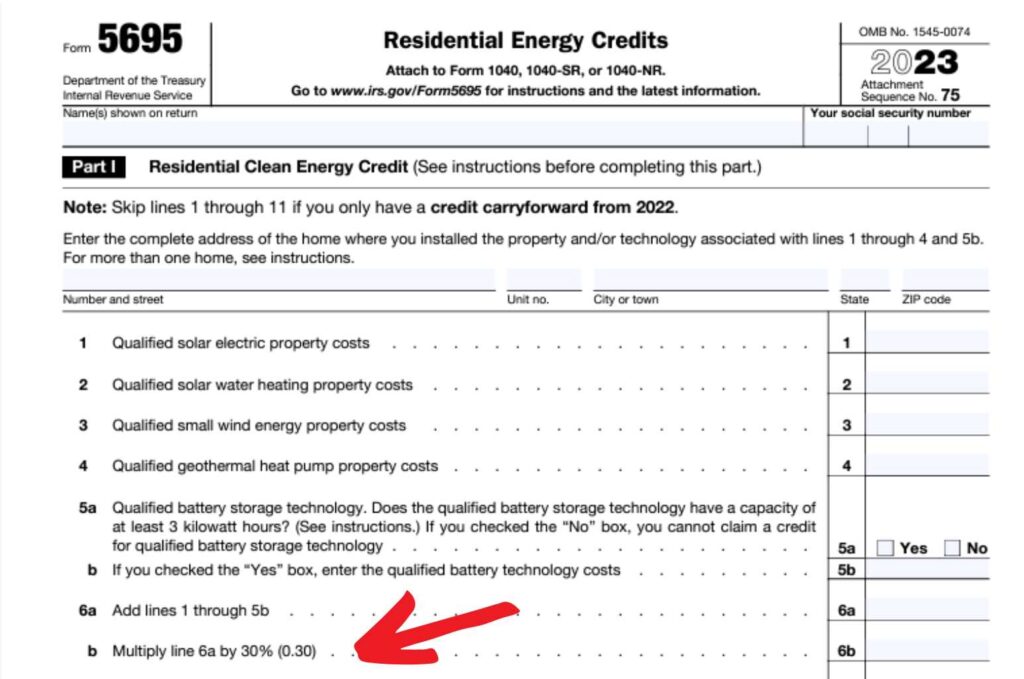

To claim the credit, you’ll file IRS Form 5695 as part of your tax return. You calculate the credit on the form, and then enter the result on your 1040.

Here’s a screenshot of the 2023 Form 5695. You can see that line 6b asks you to multiply your total by 30%. So for example, if your project’s total cost was $30,000, you’d enter that on line 1 and line 6a, multiply that by .30 and then enter the resulting $9,000 on line 6b.

What if I don’t have enough tax liability to take the full credit in one year?

If you end up with a bigger credit than you have income tax due—a $3,000 credit on a $2,500 tax bill, for instance — you can carry the credit over to the following tax years for as long as the credit is available. You’ll get 30% on your carryover through 2032, and after that you’ll get 26% in 2033 and 22% in 2034. In 2035, the credit goes away.

Of course, we’re solar experts, not tax experts!

This information is meant to be a general guide. You can find all of the updated policy for residential customers under Section 25D of the IRS tax code. Please make sure to consult your tax advisor for instructions and details about your specific situation.

Get in touch!

We’re always happy to talk through any questions you have. Feel free to reach out with your questions about the 30% federal tax credit any time. Give us a call at (202) 280-2285 or fill in the form on our website to reach out!